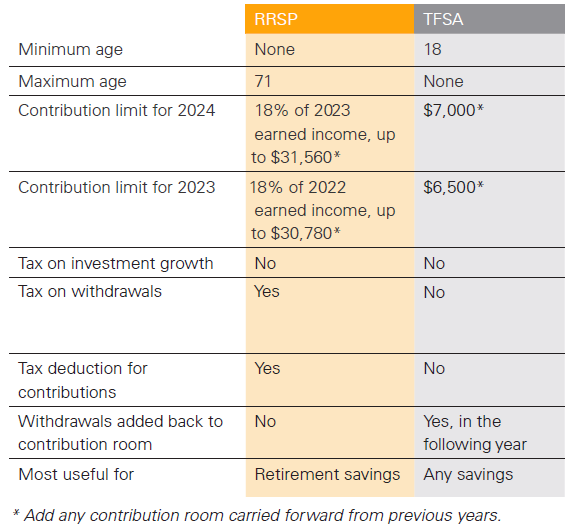

2024 TFSA Contribution Limit is $7,000

• $7,000 for 2024

• $6,500 for 2023

• $6,000 for 2022, 2021, 2020 and 2019

• $5,500 for 2018, 2017 and 2016

• $10,000 for 2015

• $5,500 for 2013 and 2014

Disclaimers

Ventum Financial Corp. is a member or participating organization of the Canadian Investor Protection Fund (CIPF), Canadian Investment Regulatory Organization (CIRO), TSX, TSX-V, and Bourse de Montreal. Information contained herein represent the views of the writer, and not those of Ventum Financial Corp. or Ventum Financial (US) Corp. (collectively “Ventum Financial”), based on assumptions which the writer believes to be reasonable. The material contained herein is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. While the information herein cannot be guaranteed, it was obtained from sources the writer believes to be reliable, but in providing it neither the writer nor Ventum Financial assume any liability. This information is given as of the date appearing on this report, and the writer and Ventum Financial assume no obligation to update the information or advise on further developments relating to securities, products or services. This report is intended for distribution in those jurisdictions where Ventum Financial is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.