Our ability to see around corners and deliver with expertise is what set us apart.

wealth advisor blog

January 15, 2025

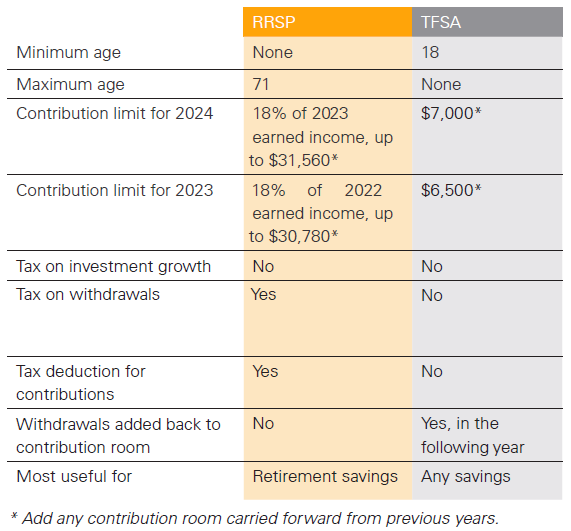

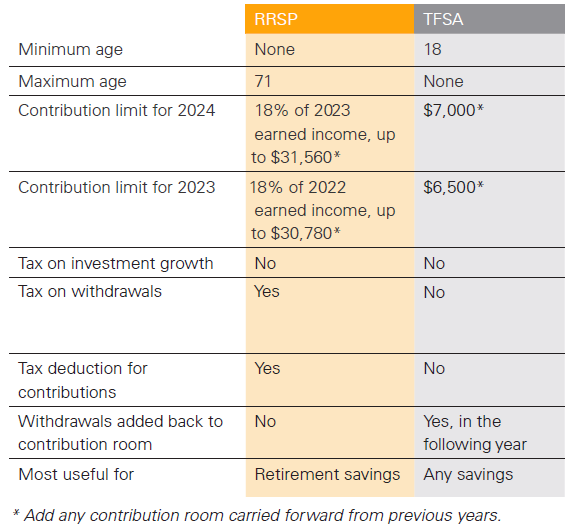

A Registered Retirement Savings Plan (RRSP) can help you build long-term savings faster with tax-deferred investment growth, while offering a valuable tax deduction for your contributions. Here’s a quick summary of the key features and benefits of an RRSP. Tax Deferral When you invest inside a non-registered account, you pay tax every year on investment income (such as interest and dividends) and capital gains (if you sell an investment that has increased in value). In contrast, when you invest inside a registered account such as an RRSP , you don’t pay any tax on your investments as long as your money remains inside the plan. The deferral of tax until withdrawal helps money inside an RRSP grow more quickly than it would in a non registered account. It’s only when you start taking money out of your RRSP that you pay tax. Withdrawals are treated as taxable income – but ideally you will wait to withdraw until you retire, at which point, your overall income, and marginal tax rate, should be lower. Tax Deduction The other major benefit of an RRSP is that you can deduct the contributions you make from your income to reduce your taxes. Contributions made during the past year or the first 60 days of 2024 can be applied against this year’s income when you file your taxes. Assuming a 40% marginal tax rate, every $1,000 contributed to an RRSP can save $400 in taxes. You can also choose to carry forward the tax deduction and claim it in a future year – a strategy that may make sense if for example, you expect next year’s income will be = highert han this year’s. Your money can start growing on a tax deferred basis right away, and you can time the deduction so it has the greatest impact on your taxes. Contribution Limit Every year you have earned income, until the end of the year you turn 71, you get additional RRSP contribution room– calculated as 18% of earned income in the previous year up to an annual limit. If you haven’t made the maximumRRSP contribution every year, you may have accumulated additional contribution room from past years, since it can be carried forward indefinitely. You can find your personal contribution limit on your latest Notice of Assessment or through the Canada Revenue Agency’s My Account website, MyCRA mobile app or the Tax Information Phone Service. Spousal Plan A spousal RRSP can be a useful income-splitting strategy, allowing the higher-income spouse to contribute to the lower-income spouse’s plan. The higher-income spouse gets the tax deduction, while withdrawals in retirement are taxed in the lower-income spouse’s hands. Even with current pension income-splitting rules, spousal RRSPs can be beneficial for couples planning to retire before age 65 and couples where one spouse is over age 71 and the other is not, as well as in certain other circumstances. Home Buyers’ Plan The Home Buyers’ Plan (HBP) allows qualifying home buyers to withdraw up to $35,000 from their RRSP to buy or build a qualifying home. The withdrawal is not taxable, but must be repaid over 15 years. Any missed repayments are taxable. Lifelong Learning Plan The Lifelong Learning Plan (LLP) allows full-time students to withdraw up to $10,000 in a calendar year and $20,000 in total from their RRSP to pay for education. The withdrawal is not taxable, but must be repaid over 10 years. Any missed repayments are taxable. Registered Retirement Income Fund When you’re ready to start withdrawing money from your RRSP, and no later than the end of the year when you turn71, you can turn your RRSP into a Registered RetirementIncome Fund (RRIF). Money continues to grow on a tax deferred basis as long as it stays in the RRIF, but you must start withdrawing a minimum (taxable) amount every year. Comparing RRSPs to TFSAs

January 1, 2025

Save for both short- and long-term goals with tax-free growth With a Tax-Free Savings Account (TFSA), you pay no taxes on investment gains, capital gains or on withdrawals, making this type of registered plan a flexible solution. Here’s a quick summary of the key features and benefits of a TFSA. Truly tax-free Unlike Registered Retirement Savings Plans (RRSPs),which defer tax until you withdraw your money, TFSAs are truly tax-free. No matter how much income, dividends and capital gains your investments generate inside a TFSA, you pay no tax – not even when you withdraw. And because withdrawals are not treated as income, they have no effect on income-tested benefits, such as Old Age Security, Employment Insurance and the GST/HST tax credits. Opportunity to re-contribute TFSAs are crafted to assist Canadians in saving for various goals with diverse time horizons. They are structured to enable multiple withdrawals and re-contributions throughout one's life. Here's how it works: any amounts withdrawn are added back to your contribution room in the following calendar year. This flexibility allows you to re-contribute, letting your money compound tax-free once again. In contrast, withdrawing from an RRSP results in a permanent loss of that contribution room. No upper-age limit A TFSA has no maximum age limit, providing the flexibility to continue growing your money tax-free and making contributions throughout your retirement. This stands in contrast to an RRSP, which must be closed at the end of the year before turning 71. In such cases, it must be transferred to either an RRIF or annuity, both of which generate taxable income, or cashed out, with the full amount taxed as income for that year. Contribution limit While the RRSP contribution limit is tied to earned income, the TFSA contribution limit is the same for all Canadian residents over the age of 18: • $7,000 for 2024 • $6,500 for 2023 • $6,000 for 2022, 2021, 2020 and 2019 • $5,500 for 2018, 2017 and 2016 • $10,000 for 2015 • $5,500 for 2013 and 2014 • $5,000 for 2012, 2011, 2010 and 2009 Your contribution limit accumulates whether or not you filed a tax return or opened a TFSA. So, any Canadian resident who was 18 or older in 2009 and has never contributed to a TFSA has $95,000 in contribution room available in 2024. You can find your personal contribution limit through the Canada Revenue Agency’s My Account website, MyCRA mobile app or the Tax Information Phone Service. Keep in mind that, unlike contributions to an RRSP, contributions to a TFSA are not tax-deductible. Spousal contributions You can simply give your spouse money to make a TFSA contribution, with no tax consequences. Comparing RRSPs to TFSAs

December 29, 2024

Over the past few weeks, I have had numerous conversations with clients and people within the industry, where the topic of discussion eventually turns to the lack of volume and general malaise of the TSX Venture Exchange. But just how poor are trading volumes (or liquidity as we call it) of late? How does the current low liquidity compare to previous periods? Might liquidity dry up even further? In this blog post we address these questions as we delve into and explore the enigma of low volume on the TSX Venture Exchange: A Ghost Town of Trading. Ye Olde TSX Venture Exchange

December 15, 2024

Benefits to Investing Through & Contributing to an RRSP I wanted to take a moment to explain the benefits of investing through an RRSP (Registered Retirement Savings Plan). An RRSP is a government-registered savings plan that allows you to save for your retirement in a tax-efficient way. Contributions made to an RRSP are tax-deductible, which means that they can be used to reduce your taxable income for the year in which they are made. This can result in a lower tax bill for the current year and more money to invest for your future. Investing through an RRSP also allows your money to grow tax-free until you withdraw it at retirement. This means that any capital gains, dividends, or interest earned on your investments will not be subject to taxes until you take the money out. Additionally, RRSPs offer a variety of investment options, including stocks, bonds, mutual funds, and exchange-traded funds, allowing you to diversify your portfolio and potentially earn higher returns on your investment. In summary, investing through an RRSP can help you save for your retirement in a tax-efficient way, allowing your money to grow tax-free and providing you with a variety of investment options. I recommend considering contributing to an RRSP as part of your overall financial plan. Important RRSP Information & Deadlines The RRSP deadline for 2022 is midnight of March 1st, 2023 . As always, late contributions cannot be accepted and cannot be backdated. Regarding the RRSP deadline date, funds must be received by PI on March 1st to be included on the last contribution receipt for the tax year. Cheques received in the mail after March 1st cannot be backdated. Please note that sending of funds by the banking bill payment process can take up to 3 days to be received by PI. We will only be including funds as a contribution if funds are received in PI’s bank account by March 1st (even if you initiated the payment before March 1st). Contribution Limits The RRSP contribution limit for 2022 is $29,210 and the limit for 2023 is $30,780. Please note however that the formula for determining an individual’s contribution limit has not changed and remains at 18% of the taxpayer’s earned income for the preceding taxation year. As such, the maximum contribution that may be made to a RRSP is the lesser of 18% of the annuitants earned income for the preceding taxation year, up to the maximum for the corresponding year indicated above. Spousal RRSP Accounts Please be advised that unless indicated otherwise, we assume all contributions made to a spousal RRSP account are spousal contributions. If you wish to make a regular contribution (non-spousal) to a spousal account, you must indicate this clearly on the cheque or on the instructions that are provided to us. We cannot amend any tax slips to be a personal contribution in a Spousal RRSP if a client did not inform us that it was a personal contribution at time of deposit. Contribution Receipts for 2022 Tax Year Contribution receipts for tax year 2022 for all contributions made between March 2nd, 2022 - December 31st, 2022 were mailed out in mid-January. All subsequent contributions made for tax year 2022 made between: January 1st, 2023 – February 17th, 2023, will be mailed out end of February. February 20th, 2023 – March 1st, 2023, will be mailed out Mid March Any contribution received from January 01 – March 1st, 2023 will automatically be assumed as contribution for year 2022 unless otherwise specified. Please contact me if you have any questions pertaining to RRSPs or if you would like to discuss further ( justin.hayek@ventumfinancial.com )

December 1, 2024

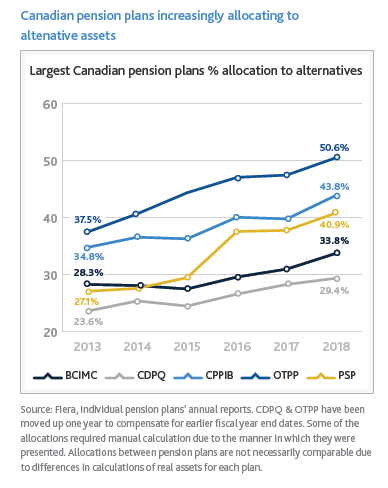

In an investment universe where stocks are at or near all-time highs, bond yields and interest rates near all-time lows it is becoming increasingly difficult to find investment opportunities offering a favourable risk-reward ratio or securities deemed undervalued. However, there are asset classes outside of the traditional which exist, that perhaps offer investors better potential outcomes; a way to help improve their returns, generate more income or for diversification to help mitigate downside risk. I am referring to alternative assets. What are alternative assets? The term is flexible however it can be loosely defined as an asset class which does not fit under traditional asset classes of stocks, bonds, or cash. The below is a list of different types of alternative assets though not exhaustive. private equity – pooled fund investing into private companies private debt/credit – debt or credit not financed by banks or traded on an open market. Both public and private companies, and persons can borrow via private debt/credit hedge funds – pooled investment fund able to make use of complex trading strategies, shorting, and possibly leverage real estate / land– refers to all types; commercial, industrial, residential, agriculture infrastructure – long-lasting capital assets that add value to land and tend to be part of a larger system eg: bridges, roads, airports commodities – precious & base metals, oil, agriculture collectibles – art, wine, vintage cars, watches, sports memorabilia cryptocurrencies & digital assets – bitcoin, NFTs structured products - structured products and derivatives, or securities whose value comes from an underlying asset or group of assets like stocks, bonds, or market indices. Adoption of alternative asset classes into investment portfolios Alternative assets are being utilized by sophisticated investors probably more than you might expect. Some of the world’s largest asset managers are turning to alternative assets to help diversify and add value to their investment portfolios. Consider the following published by Fiera Capital¹. Canada’s largest pension plans have allocated as much as 50% of their portfolios to alternative assets.

November 29, 2024

Recently we conducted a web conference to introduce PI Financial's discretionary managed accounts program (more info here ). Joining me for the web conference was the head of PI Financial's discretionary managed accounts program Bert Quattrociocchi. Bert is a Certified Portfolio Manager and has held positions in research, banking, institutional and retail sales throughout his 32 years in the investment industry. He is currently a senior portfolio manager and a member of PI Financial’s Executive Committee and Board of Directors. Through the web conference, Bert gives an overview of each portfolio and its unique investment objective, risk profile and holdings. You might be interested in knowing, there is likely a portfolio (or two) that is suitable for you - whether you desire investment income, capital appreciation, or a combination of the two. More on this below. To give you some context and more information, below are the six model portfolios along with a short description for each. Video: Introduction to PI Financial's Discretionary Managed Accounts Program

November 15, 2024

After last week's blog about PI Financial's discretionary managed accounts program, I had received several emails from clients asking about the 6 unique portfolios overseen by our internal portfolio management team and how they differ from one another. As mentioned before, each portfolio is unique in its investment objective, risk profile and composition (holdings). Whether you desire investment income or seeking primarily capital appreciation; there is a portfolio (or two) that is suitable for you. To give you some context and more information, below are the six model portfolios along with a short description for each... but if you want even more info, join me and our internal portfolio management team for a web conference Tuesday February 25th at 1:30PM by replying to this email and confirming your attendance. The Six Model Portfolios PI Balanced - is a multi-asset class portfolio primarily consisting of money market, fixed income and equity securities in Canada and the US with the objective of balancing risk and return. This portfolio aims to provide a total return consisting of capital appreciation, dividend income and interest income. This portfolio is best suited for the more defensive long term investor seeking broad asset, country and sector diversification and moderate income. PI High Yield Dividend Growth - is a Canadian all-equity portfolio with the objective of providing equity investors with a high dividend yield, a lower level of volatility to its benchmark, growing dividend income and moderate long-term capital appreciation. To reduce risk this portfolio invests only in the more defensive sectors, such as utilities, real estate, telecom, financials and consumer staples and only in companies which have consistently grown their dividends per share for at least the past 5 years. PI Canadian Dividend Growth - is a Canadian all-equity concentrated portfolio consisting of between 20 to 30 large blue-chip Canadian listed companies. Each company must have a long record of consistently growing their dividend per share combined with a positive long term price trend. PI Canadian Equity - is our core Canadian large-cap equity portfolio holding the full range of Canada’s leading blue chip companies. The portfolio’s investment objective is long term capital appreciation with moderate dividend income. This portfolio will invest from Canada largest 100 companies and only the leading companies with long term record of financial success including consistent profitability and sound balance sheet. PI Canadian Equity PLUS - is an all-equity growth portfolio with about 70% of the portfolio invested in a broad range of individual leading Canadian companies plus approximately 30% invested in US, Global and Emerging Market ETFs. The portfolio’s investment objective is long term capital appreciation with moderate dividend income. PI Focus 15 - is a model equity portfolio consisting of up to 15 mid- to large capitalization Canadian listed companies with an investment objective of long term capital appreciation. For more information on any of the six above managed portfolios, please view the short summary here Why Might You Consider PI Financial's Discretionary Managed Accounts Program There are a number of benefits and reasons why, but I believe it comes down to three: You are interested in a lower volatility portfolio compared to junior/micro-cap equities. In other words: lower risk investments You desire investment income from your portfolio You want investment professionals to make all the investment decisions on your behalf. Freeing up your time. If you are interested in learning more about the six managed portfolios, our internal portfolio management team or how you can benefit from both join us for a web conference Tuesday February 25th at 1:30PM PST by replying to this email or calling me to discuss further 604-718-7576.

By Website Editor

•

November 1, 2024

In my last blog post I highlighted PI Financial's discretionary managed accounts program. This program is overseen by our internal portfolio management team who manages six unique model portfolios consisting of mid to large cap equities, bonds and ETFs. In other words, blue chip-type investments. The discretionary managed accounts program is ideal for you if you want: Risk-management from venture capital investments - investing in diversified portfolio of leading mid-large cap companies, fixed income & ETFs Generate reliable dividend income - investing in mid-large cap, reliable dividend paying companies & fixed income products Free up your time – eliminate the time you spend self-managing your investments and focus on enjoying life Tax deductible advisory fee – fees may be tax deductible, reducing income taxes you pay Investments managed by professionals – see measurable results by having true professionals manage your investments Each of the six portfolios is unique in its investment objective and risk-reward profile. Given the diversity between the portfolios, there is one or multiple portfolios which will fit your desired investment outcome. Whether you are seeking dividend income, serious potential price appreciation or a combination of the two, our portfolio management team can help you. To view a brief description of each model portfolio take a look here . If our discretionary managed accounts program is of interest to you, I encourage to you join us for a web conference Tuesday February 25th at 1:30pm PST . Dial in details will follow. Joining me for the web conference will be Mr. Bert Quattrociocchi - head of our discretionary managed accounts program. Bert is a Certified Portfolio Manager and has held positions in research, banking, institutional and retail sales throughout his 32 years in the investment industry. He is currently a senior portfolio manager and a member of PI Financial’s Executive Committee and Board of Directors. To learn more about our discretionary managed accounts sign up for the web conference by clicking here or calling me today to sign up 604-718-7576. I look forward to having join us for the web conference.