A Registered Retirement Savings Plan (RRSP) can help you build long-term savings faster with tax-deferred investment growth, while offering a valuable tax deduction for your contributions. Here’s a quick summary of the key features and benefits of an RRSP.

Tax Deferral

When you invest inside a non-registered account, you pay tax every year on investment income (such as interest and dividends) and capital gains (if you sell an investment that has increased in value). In contrast, when you invest inside a registered account such as an RRSP , you don’t pay any tax on your investments as long as your money remains inside the plan. The deferral of tax until withdrawal helps money inside an RRSP grow more quickly than it would in a non registered account. It’s only when you start taking money out of your RRSP that you pay tax. Withdrawals are treated as taxable income – but ideally you will wait to withdraw until you retire, at which point, your overall income, and marginal tax rate, should be lower.

Tax Deduction

The other major benefit of an RRSP is that you can deduct the contributions you make from your income to reduce your taxes. Contributions made during the past year or the first 60 days of 2024 can be applied against this year’s income when you file your taxes. Assuming a 40% marginal tax rate, every $1,000 contributed to an RRSP can save $400 in taxes. You can also choose to carry forward the tax deduction and claim it in a future year – a strategy that may make sense if for example, you expect next year’s income will be = highert han this year’s. Your money can start growing on a tax deferred basis right away, and you can time the deduction so it has the greatest impact on your taxes.

Contribution Limit

Every year you have earned income, until the end of the year you turn 71, you get additional RRSP contribution room– calculated as 18% of earned income in the previous year up to an annual limit. If you haven’t made the maximumRRSP contribution every year, you may have accumulated additional contribution room from past years, since it can be carried forward indefinitely. You can find your personal contribution limit on your latest Notice of Assessment or through the Canada Revenue Agency’s My Account website, MyCRA mobile app or the Tax Information Phone Service.

Spousal Plan

A spousal RRSP can be a useful income-splitting strategy, allowing the higher-income spouse to contribute to the lower-income spouse’s plan. The higher-income spouse gets the tax deduction, while withdrawals in retirement are taxed in the lower-income spouse’s hands. Even with current pension income-splitting rules, spousal RRSPs can be beneficial for couples planning to retire before age 65 and couples where one spouse is over age 71 and the other is not, as well as in certain other circumstances.

Home Buyers’ Plan

The Home Buyers’ Plan (HBP) allows qualifying home buyers to withdraw up to $35,000 from their RRSP to buy or build a qualifying home. The withdrawal is not taxable, but must be repaid over 15 years. Any missed repayments are taxable.

Lifelong Learning Plan

The Lifelong Learning Plan (LLP) allows full-time students to withdraw up to $10,000 in a calendar year and $20,000 in total from their RRSP to pay for education. The withdrawal is not taxable, but must be repaid over 10 years. Any missed repayments are taxable.

Registered Retirement Income Fund

When you’re ready to start withdrawing money from your RRSP, and no later than the end of the year when you turn71, you can turn your RRSP into a Registered RetirementIncome Fund (RRIF). Money continues to grow on a tax deferred basis as long as it stays in the RRIF, but you must start withdrawing a minimum (taxable) amount every year.

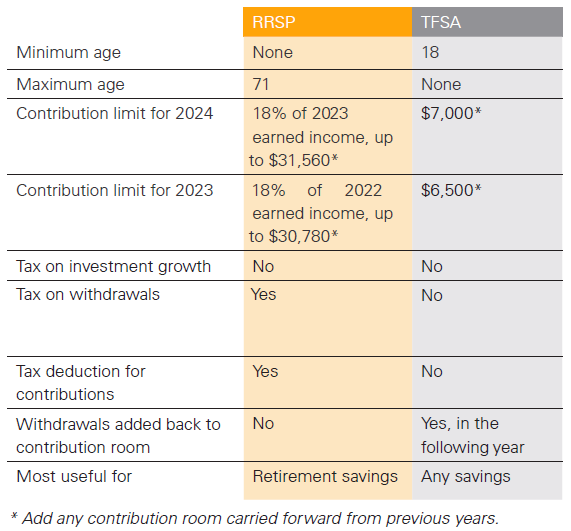

Comparing RRSPs to TFSAs

Save taxes and accelerate your retirement savings

March 1, 2024 is the deadline to make RRSP contributions that you can apply towards your 2024 taxable income.

Please consult with a tax professional to discuss your personal tax circumstances.

Contact Justin today to find out more about how an RRSP, a TFSA or both can help you pay less in taxes and achieve your savings goals.