Testimonials Home Page

Testimonials

“Justin has proven his worth by being more than an investment advisor. He tries to bring value to every interaction and is a name to watch in this industry going forward.” - Fabiana Lara, creator of The Next Big Rush

"Justin Hayek has been my investment advisor for over 7 years. I find his market knowledge invaluable. He has helped my portfolio grow, exceeding my expectations. I will continue to take advantage of his expertise and would highly recommend him to anyone looking for a fantastic advisor!" - Chase Shymkiw, Maple Ridge, BC

Are you looking for a superior dividend yield? Look to Mortgage Investment Corporations

In my last blog post (link here) I highlighted alternative assets. The alternative asset I want to focus on here is private credit/debt. As a refresher, private credit/debt is debt or credit not financed by banks or traded on an open market. Both public and private companies, and persons can borrow via private debt/credit.

Of particular interest - qualifying as private credit/debt - are mortgage investment corporations (MIC).

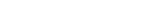

A MIC is a pool of funds, similar to a mutual fund, invested in a diversified portfolio of residential, commercial or industrial mortgage loans. A management company performs the day-to-day administration of the mortgage investment corp. Each year the MIC must pay 100% of its net income out to investors/unit holders.

Source: Antrim Investments [altered from source]

Effectively, unitholders/investors of a MIC provide credit to borrowers in the form of a loan (mortgage) secured against real estate. MICs can be viewed as a substitute and competitor to the big banks and credit unions however they have only managed to capture a fraction of the mortgage market.

According to a report by CMHC1, in 2018 there were over 200 active MICs in Canada with a total market size of approximately $12.5 billion, representing less than 1% of outstanding mortgages in Canada.

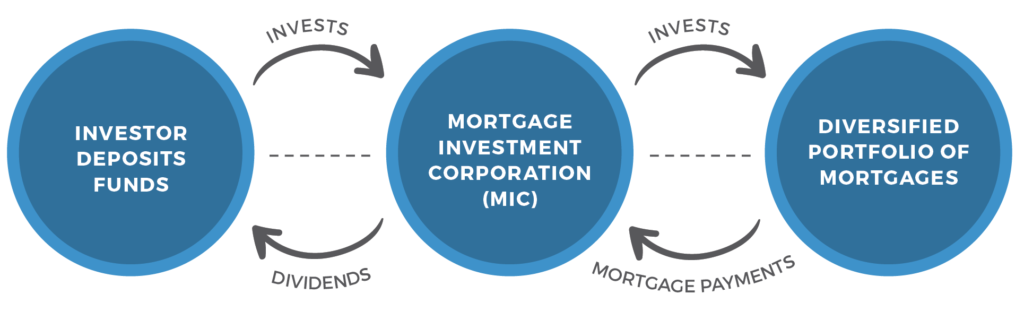

Most MICs provide a short-term (typically 1 yr) loan to the borrower in the form of primarily a 1st or 2nd mortgage with a loan-to-value (LTV) ratio of up to 75%.

Note a higher LTV ratio means more risk to the lender as there is less equity in the home and greater potential for loan losses. The opposite is true for a lower LTV.

Loan-to-Value Ratio

Benefits to investing in a MIC

For those looking for a superior dividend yield, mortgage investment corporations are a very reasonable option.

- Many MICs pay a dividend every quarter with a top up dividend at the end of the fiscal year, passing on all income to its unitholders. The dividend yield MICs pay out differs greatly however they generally range from 4%-8% per annum.

- The market price per unit of a MIC typically does not change. That is, a unit of a MIC is priced at a constant price (say $1 per unit) and remains as such. The primary variable is the dividend yield which may change depending on interest rates, efficiency of the fund’s cash management, portfolio turnover etc. For example, the MIC highlighted below has always had its unit priced at $1.00, even through the global financial crisis of 2008-2009.

Compare this to an index ETF (CDZ.TO) of some of the highest yielding, large cap TSX companies. Yields are similar however the price volatility that listed equities are subject to can be significant. A major share price decline can wipe out any dividend income plus some. Stocks do have the potential for price appreciation however.

High Yield Dividend ETF Share Price Volatility

To help get a better handle on the ins and outs of this unique investment product, I asked the expert on mortgage investment corporations, Will Granleese of Antrim Investments, to chat with me via ZOOM.

About Will Granleese and Antrim Investments

Will Granleese is the CEO, COO and lead portfolio manager for the Antrim Balanced Mortgage Fund. Antrim’s Balanced mortgage fund is one of the largest residential MICs in Canada with over $770 million in its portfolio consisting of over 1,700 loans. Antrim, through applications received from its mortgage broker partners (including RBC & CIBC), provides first and second mortgages on residential properties primarily in BC and Alberta.

Will is the past president of the British Columbia Mortgage Investment Corporation Managers Association and a recipient of BC Business’ Top 40 under 40 award (link here).

To watch the ZOOM webinar on MICs here

Topics of discussion in the webinar include:

- General overview of what is a MIC, and the mechanics of how it works

- How does an administrator of a MIC, like Antrim, mitigate the risks?

- Why might someone want to consider investing in a MIC?

- What differentiates Antrim’s Balanced Mortgage Fund from competitors?

As touched on in the video above, there are risks to investing in a MIC. The general risks are:

- There is risk. This is not a GIC ie. not guaranteed by the government, hence why investors receive a higher rate

- Rates are subject to change. Because the mortgages are shorter duration (up to 12 months) they are subject to rate changes upon renewal. Should interest rates decline further, so too will the dividend yield on MICs

- MICs are inherently tied to the economy and housing market. Should the economy or housing market decline significantly, and borrowers default, the MIC may need to put the home into foreclosure and so needs to recoup principal & interest by selling the home at prevailing market prices

- Liquidity constraints. In the event of significant investor redemptions, a MIC may not have the necessary liquidity to meet all redemptions

Mitigating the Risks

A number of measures and strategies can be used by the manager of the MIC in order to mitigate risk exposure. The below strategies and measures were mentioned by Will Granleese of Antrim as to how they mitigate their risk exposure;

- Having a sufficient line of credit with a tier 1 bank to meet large redemption requests and for cash management purposes. Antrim currently has a $100 million line of credit in place.

- Focus on lending against homes in urban areas (namely Vancouver & Toronto). The higher level of sales activity allows for greater liquidity in the event of a foreclosure.

- Mortgages only on residential real estate. More liquidity, higher market transparency than commercial, industrial real estate.

- Hold many mortgages in the portfolio in order to reduce single loan exposure (over 1,700 loans in Antrim’s portfolio).

- Reducing the portfolio’s loan-to value (LTV). This means the homeowner has more equity built into their home thus creating more of a buffer against a loan loss for the MIC. Antrim currently has a LTV of 59% on its portfolio (that is there as an equity buffer of 41% on value of homes).

Portfolio Snapshot for Antrim Balanced Mortgage Fund (as of June 2021)

- 1780 residential mortgage loans

- $770 Million portfolio size

- 86% 1st Mortgages

- 14% 2nd Mortgages $400,000+ Average mortgage size

- 59% weighted average Loan-to Value based on appraised value on the date of funding - if calculated on today's values this number would be much less.

Why choose Antrim Balanced Mortgage Fund?

I am comfortable investing in this MIC primarily for these reasons:

- Superior dividend yield. Currently 5-6% per annum

- Liquidity. The fund has no liquidity constraints in terms of buys and sales. Trades settle in 2 business days. Plus, access to a $100 million line of credit allows the fund to meet investor redemptions

- Diversification. Holding a portfolio of over 1,700 mortgages means no one mortgage is material enough to adversely impact the portfolio

- Management has skin in the game... A lot of it. Will Granleese as the portfolio manager has over $17.8 million personally invested in the fund.

For those investors seeking reliable, consistent income from their investments, a mortgage investment corporation is a sound option. Each MIC has to be carefully assessed though as the structure and portfolio composition varies greatly for each.

If you wish to discuss how investing in a MIC may be of benefit to you or wish to discuss investing in the Antrim Balanced Mortgage Fund specifically, please contact me today (jhayek@pifinancialcorp.com or 604-718-7576)

References