Testimonials Home Page

Testimonials

“Justin has proven his worth by being more than an investment advisor. He tries to bring value to every interaction and is a name to watch in this industry going forward.” - Fabiana Lara, creator of The Next Big Rush

"Justin Hayek has been my investment advisor for over 7 years. I find his market knowledge invaluable. He has helped my portfolio grow, exceeding my expectations. I will continue to take advantage of his expertise and would highly recommend him to anyone looking for a fantastic advisor!" - Chase Shymkiw, Maple Ridge, BC

Exploring Alternative Assets

Submitted by Justin Hayek on September 15th, 2021In an investment universe where stocks are at or near all-time highs, bond yields and interest rates near all-time lows it is becoming increasingly difficult to find investment opportunities offering a favourable risk-reward ratio or securities deemed undervalued.

However, there are asset classes outside of the traditional which exist, that perhaps offer investors better potential outcomes; a way to help improve their returns, generate more income or for diversification to help mitigate downside risk. I am referring to alternative assets.

What are alternative assets?

The term is flexible however it can be loosely defined as an asset class which does not fit under traditional asset classes of stocks, bonds, or cash. The below is a list of different types of alternative assets though not exhaustive.

- private equity – pooled fund investing into private companies

- private debt/credit – debt or credit not financed by banks or traded on an open market. Both public and private companies, and persons can borrow via private debt/credit

- hedge funds – pooled investment fund able to make use of complex trading strategies, shorting, and possibly leverage

- real estate / land– refers to all types; commercial, industrial, residential, agriculture

- infrastructure – long-lasting capital assets that add value to land and tend to be part of a larger system eg: bridges, roads, airports

- commodities – precious & base metals, oil, agriculture

- collectibles – art, wine, vintage cars, watches, sports memorabilia

- cryptocurrencies & digital assets – bitcoin, NFTs

- structured products - structured products and derivatives, or securities whose value comes from an underlying asset or group of assets like stocks, bonds, or market indices.

Adoption of alternative asset classes into investment portfolios

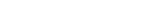

Alternative assets are being utilized by sophisticated investors probably more than you might expect. Some of the world’s largest asset managers are turning to alternative assets to help diversify and add value to their investment portfolios. Consider the following published by Fiera Capital1. Canada’s largest pension plans have allocated as much as 50% of their portfolios to alternative assets.

According to an RBC survey2 of pension managers conducted in 2021, “Nearly 80% of respondents that [already] incorporate alternatives into their plans are looking to make increased allocations to one or more of their alternative investments in the near term—up from 72% last year”.

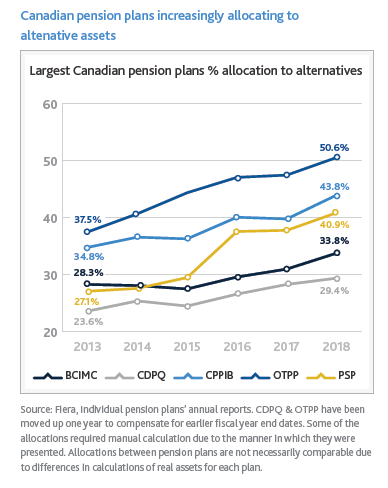

However, its not just the sophisticated pension fund manager who has accepted and adopted alternative assets into their portfolio mix, the retail investor has too. According to Mackenzie Investments3, alternative assets managed in Canada has seen meaningful growth over the years.

Benefits to investing in alternative assets

This of course begs the question as to why? Why have some of the most sophisticated and scrutinized investors allocated more of their investment capital to these asset classes. The answer is twofold:

- enhance a portfolio’s diversification. That is to say, reduce downside risk and volatility

- improve returns in a portfolio

This is also true for the retail investor who is currently invested in alternative assets. Mackenzie Investments3 is of the viewpoint that:

“The market disruption of 2008-2009, and the periods of volatility that followed, have encouraged retail investors to search for ways to limit their market risk and to identify investments that are unlikely to move in lock-step with the public markets.’’

Another reason investors are turning to alternative assets is given the low interest rate environment we find our selves in, it has become increasingly difficult to generate sufficient reliable income from traditional investments (stocks, cash, bonds and GICs).

Consider the below. Government of Canada 10 year bond yields (1995-2021). It used to be the case you could buy this bond, hold for 10 years and expect a rate of return of over 7% per annum. Today that number on the 10 year Government of Canada bond is a sad 1.25%. This has forced many of those who count on their investments to fund and carry them through their retirement years, to live with lesser means or search for alternative investments.

10 year Government of Canada Bond Yield (1995-2021)

The risks to investing in alternative assets

Alternative assets are investments. And as such, with any investment, carries risk. Each of the different types of alternative assets aforementioned has its own unique characteristics, benefits and risks. However, generally speaking the key risks within the alternative assets3:

- difficulty accessing the investments

- difficulty to value the investments

- limited liquidity

- need to adopt long term time horizon

- often high initial investment

- relatively high cost

Despite the above risks associated, I do believe its possible to find the right investment opportunities within the alternative asset classes fitting the objectives and risk tolerance for many investors.

However in my opinion, the primary way to mitigate risk is to have the right management team administrating and managing the asset in question. As a quality manager will have the expertise and resources required to access and value the investment opportunities. Thus eliminating one-third of the above mentioned risks.

For this reason, I have entrusted outside professionals, who are top tier in their practice, to overlook and manage alternative investments I have made personally or through our business practice.

My intention in follow up blog posts is to highlight some alternative assets I have already personally invested in along side clients. As well as highlight new investment opportunities I have discovered and sharing with clients for the first time.

References:

https://www.fieracapital.com/en/insights/alternative-facts-how-alternati... retrieved September 9, 2021

https://www.rbcits.com/en/our-insights/pathways-to-sustainability/altern... retrieved August 20, 2021

https://www.mackenzieinvestments.com/content/dam/final/corporate/mackenz... retrieved August 10, 2021