Testimonials Home Page

Testimonials

“Justin has proven his worth by being more than an investment advisor. He tries to bring value to every interaction and is a name to watch in this industry going forward.” - Fabiana Lara, creator of The Next Big Rush

"Justin Hayek has been my investment advisor for over 7 years. I find his market knowledge invaluable. He has helped my portfolio grow, exceeding my expectations. I will continue to take advantage of his expertise and would highly recommend him to anyone looking for a fantastic advisor!" - Chase Shymkiw, Maple Ridge, BC

2024 TFSA Contribution Limit is $7,000

Submitted by Justin Hayek on January 8th, 2024

Save for both short- and long-term goals with tax-free growth

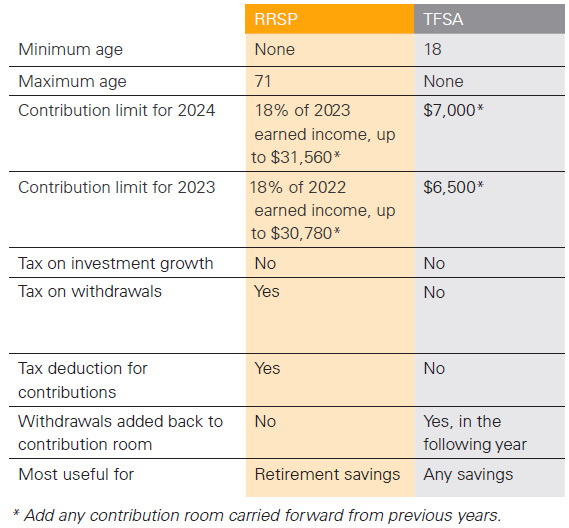

With a Tax-Free Savings Account (TFSA), you pay no taxes on investment gains, capital gains or on withdrawals, making this type of registered plan a flexible solution. Here’s a quick summary of the key features and benefits of a TFSA.

Truly tax-free

Unlike Registered Retirement Savings Plans (RRSPs),which defer tax until you withdraw your money, TFSAs are truly tax-free. No matter how much income, dividends and capital gains your investments generate inside a TFSA, you pay no tax – not even when you withdraw. And because withdrawals are not treated as income, they have no effect on income-tested benefits, such as Old Age Security, Employment Insurance and the GST/HST tax credits.

Opportunity to re-contribute

TFSAs are crafted to assist Canadians in saving for various goals with diverse time horizons. They are structured to enable multiple withdrawals and re-contributions throughout one's life. Here's how it works: any amounts withdrawn are added back to your contribution room in the

following calendar year. This flexibility allows you to re-contribute, letting your money compound tax-free once again. In contrast, withdrawing from an RRSP results in a permanent loss of that contribution room.

No upper-age limit

A TFSA has no maximum age limit, providing the flexibility to continue growing your money tax-free and making contributions throughout your retirement. This stands in contrast to an RRSP, which must be closed at the end of the year before turning 71. In such cases, it must be transferred to either an RRIF or annuity, both of which generate taxable income, or cashed out, with the full amount taxed as income for that year.

Contribution limit

While the RRSP contribution limit is tied to earned income, the TFSA contribution limit is the same for all Canadian residents over the age of 18:

• $7,000 for 2024

• $6,500 for 2023

• $6,000 for 2022, 2021, 2020 and 2019

• $5,500 for 2018, 2017 and 2016

• $10,000 for 2015

• $5,500 for 2013 and 2014

• $5,000 for 2012, 2011, 2010 and 2009

Your contribution limit accumulates whether or not you filed a tax return or opened a TFSA. So, any Canadian resident who was 18 or older in 2009 and has never contributed to a TFSA has $95,000 in contribution room available in 2024. You can find your personal contribution limit through the Canada Revenue Agency’s My Account website, MyCRA mobile app or the Tax Information Phone Service. Keep in mind that, unlike contributions to an RRSP, contributions to a TFSA are not tax-deductible.

Spousal contributions

You can simply give your spouse money to make a TFSA contribution, with no tax consequences.

Comparing RRSPs to TFSAs

Enjoy flexibility as you save for multiple goals

There is no “TFSA deadline.” You can make contributions up to your limit at any time – the sooner the better -- as you can start benefiting from tax-free compounding.

Call Justin today to find out more about how a TFSA, an RRSP or both can help you pay less in taxes and achieve your savings goals.