Testimonials Home Page

Testimonials

“Justin has proven his worth by being more than an investment advisor. He tries to bring value to every interaction and is a name to watch in this industry going forward.” - Fabiana Lara, creator of The Next Big Rush

"Justin Hayek has been my investment advisor for over 7 years. I find his market knowledge invaluable. He has helped my portfolio grow, exceeding my expectations. I will continue to take advantage of his expertise and would highly recommend him to anyone looking for a fantastic advisor!" - Chase Shymkiw, Maple Ridge, BC

Goldman Sachs Breaks Into the ETF Industry

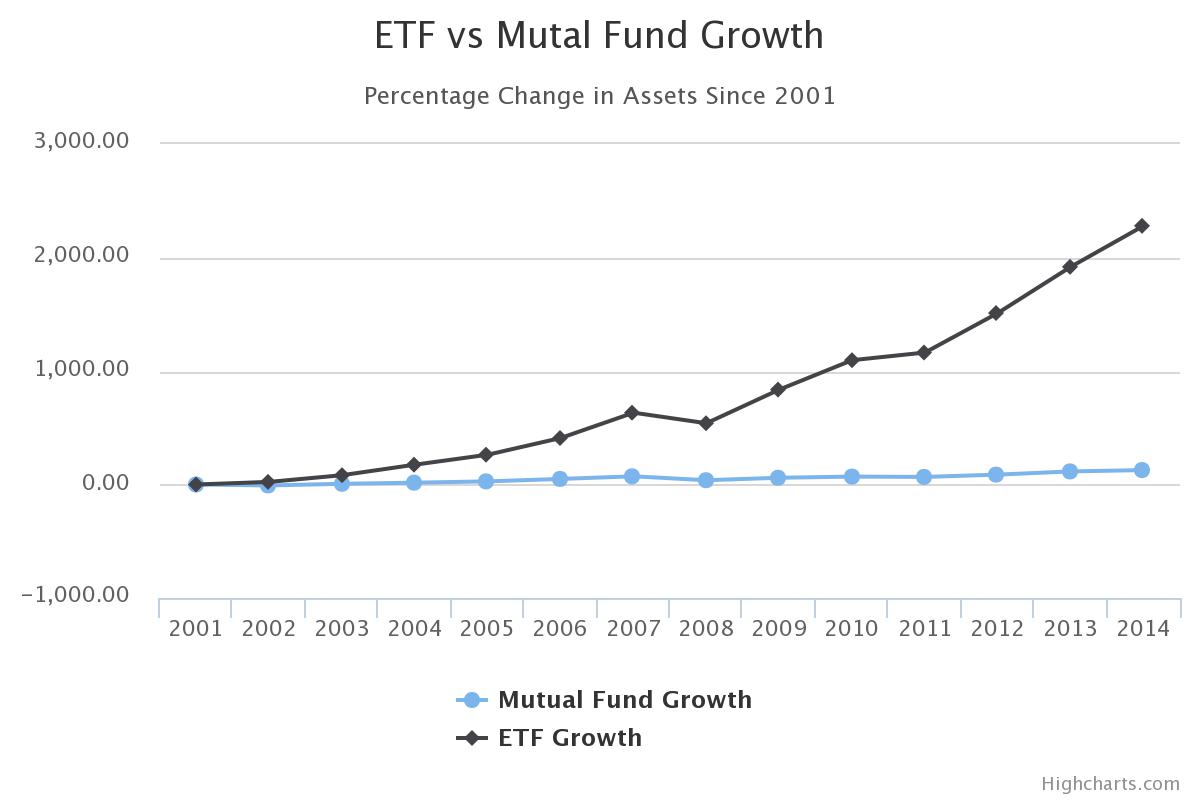

Submitted by Justin Hayek on September 22nd, 2015If there was any doubt as to whether exchange traded funds (ETFs) are just a fad or here to stay, the doubt has just been eliminated. Goldman Sachs, one of the most successful investment banks on Wall Street and 11th largest asset manager in the world, has just broken into the ETF industry launching its own set of products. Their first ETF will track the group's own "ActiveBeta" index for US Large Cap Equities.

The methodology to the ActiveBeta index is a bit overwhelming and technical, so no need to bore you with the details. But according to Goldman Sachs Asset Management, the indexes "were developed to capture performance of diversified exposure to the equity common factors: value, momentum, volatility, and quality". Basically they evaluate equity securities under the four aforementioned factors and assign a score to each factor which then determines the percentage weighting in the index.

Whether or not these ETFs managed by Goldman Sachs will perform well isn't of interest to this blog posting. Rather, what should be taken from this is the significance of an asset manager, who has offered traditional wealth management products (mutual funds, stock, bonds, etc), is diving into the growing ETF industry. With a powerhouse like Goldman Sachs in the mix, you have to believe that ETFs are here to stay.

www.etfdb.com

As of today, there is approximately $3 trillion USD of asset under management through ETFs. Goldman Sachs is forecasting that by 2020 that number will double to $6 trillion USD in assets. If you are interested in learning more about ETFs and their advantages, sign up for our upcoming webinar on ETFs here.