Testimonials Home Page

Testimonials

“Justin has proven his worth by being more than an investment advisor. He tries to bring value to every interaction and is a name to watch in this industry going forward.” - Fabiana Lara, creator of The Next Big Rush

"Justin Hayek has been my investment advisor for over 7 years. I find his market knowledge invaluable. He has helped my portfolio grow, exceeding my expectations. I will continue to take advantage of his expertise and would highly recommend him to anyone looking for a fantastic advisor!" - Chase Shymkiw, Maple Ridge, BC

How To Use ETFs to Make Profitable Trades and Protect Your Investments

Submitted by Justin Hayek on November 9th, 2015Our webinar covered the basics on exchange traded funds (ETFs) - what they are, how they are structured, their advantages and benefits. We only touched on the number of different trading strategies or investment ideas you can execute using these instruments. With that being said, below are a few ways you can use ETFs to make profitable trades, protect your investments and reduce risk in your portfolio.

Using ETFs to Buy a Specific Sector

Scanning the current market, you might find certain sectors that appear attractively priced today - take the oil and gas sector for example. If you think that oil & gas producers are cheap today and are poised to recover in the future, you may want to consider buying an ETF that covers this sector. One such ETF is iShares' S&P/TSX Capped Energy Index ETF. This ETF trades on the TSX under the symbol XEG.

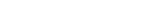

By owning this one ETF, you can own 50 of the largest oil & gas companies in the TSX. Below are the top 10 holdings in this ETF.

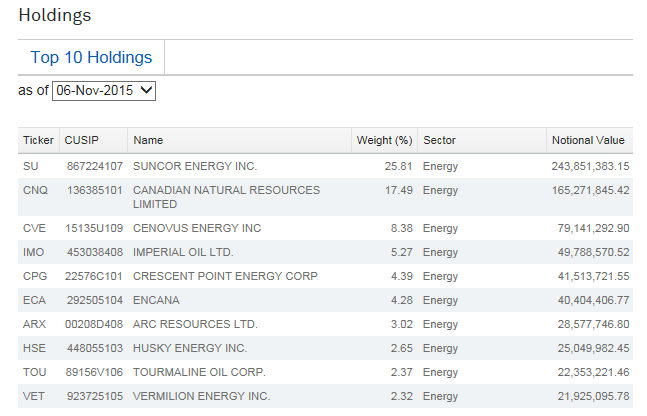

Should oil & gas prices move higher, leading the producers and exploration companies' stock to appreciate, you can benefit and profit by owning this ETF. Take a look at how it performed when oil made a strong move from $44 per barrel to $60 earlier this year. The white line indicates performance of crude oil spot price, red line indicates performance of XEG.

Maybe the oil & gas sector isn't of any interest to you, good thing is there are a number of other sectors covered by ETFs. It becomes very easy to execute a trade on a potentially profitable investment idea. Sectors covered include but are not limited to:

- global real estate

- global agriculture

- consumer staples

- bank and life insurance companies

- gold & base metals producers

- health care

Using ETFs to Bet Against the Market

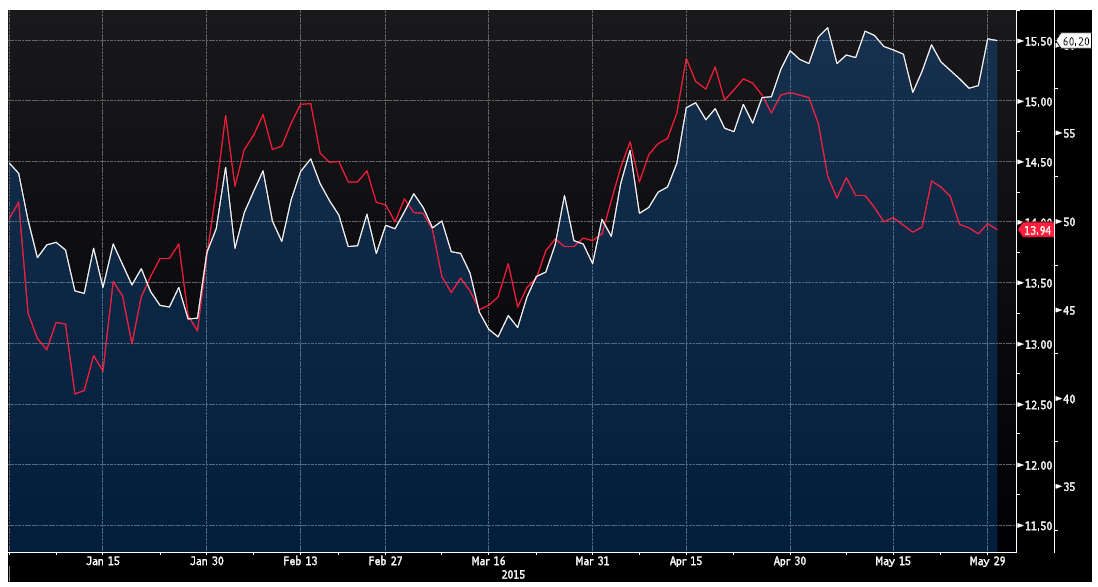

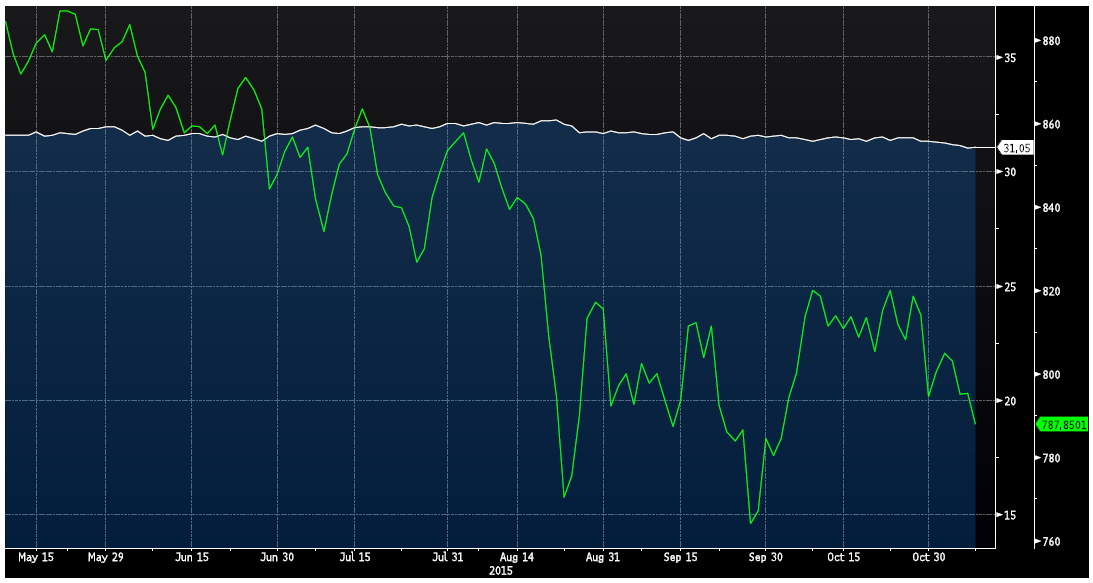

Say you are of the thought that the US stock market is heading temporarily lower in the short term. There are ETFs that exist which would enable you to profit from a market decline. One such ETF is ProShares's Short S&P 500 ETF. It seeks a return that is -1x the return of the S&P 500 for a single day. This ETF trades on the New York stock exchange (in US dollars) under the symbol SH. Had you owned this during the recent market correction of August/September, a profitable trade was to be had:

The green line indicates the performance of the US stock market (S&P 500 index) and the white line indicates the performance of Proshares' Short S&P 500 ETF. As you can see, the price of this ETF moves higher as the overall market goes lower, allowing you to profit when others are losing out.

Using ETFs to Protect Your Portfolio and Reduce Risk

Sometimes the stock market gets too volatile for even the most adventurous of investors. It's at times like these when we re-asses our portfolios and the risks we are willing to take. One of the best ways to reduce risk and protect the value of your portfolio is through the use of bonds. Bonds are less volatile than stocks and generally move up in value during market declines. As you might have guessed, there are ETFs which have been created to give you the opportunity to own a basket of bonds. iShares manages an ETF of broadly diversified range of investment grade Canadian federal, provincial, municipal and corporate short term bonds. This ETF, iShares Canadian Short Term Bond Index ETF, trades under the symbol XSB on the TSX.

The green line indicates the performance of the TSX 60 index for the last six months, the white line indicates performance of iShares Canadian Short Term Bond Index ETF. As you can see, the bond ETF is virtually unchanged even as the stock market fell part, all while paying you a dividend of ~2.4% per year. Which is certainly better than sitting on cash.

Having ETFs in your investing repertoire can lead not only to more profitable trades but also enables you to protect your investments by reducing risk. If you want to know how you can start using ETFs today please contact me.