Testimonials Home Page

Testimonials

“Justin has proven his worth by being more than an investment advisor. He tries to bring value to every interaction and is a name to watch in this industry going forward.” - Fabiana Lara, creator of The Next Big Rush

"Justin Hayek has been my investment advisor for over 7 years. I find his market knowledge invaluable. He has helped my portfolio grow, exceeding my expectations. I will continue to take advantage of his expertise and would highly recommend him to anyone looking for a fantastic advisor!" - Chase Shymkiw, Maple Ridge, BC

Is The Stock Market Crashing, Again?

Submitted by Justin Hayek on August 31st, 2015If you were paying attention to the markets last week (August 24-28) you will have noticed they were much more volatile than usual. Even if you had not intently watched the markets, you couldn’t help but hear about it in the news. Funny how the mainstream media decides to cover the markets only when there are quick and serious corrections. You never hear about the 'boring' times as the market just keeps creeping higher...but Im getting off point.

Every so often the market experiences a steep correction (10% or more). This is normal. In fact corrections of this magnitude occur so often that it really should not come as a surprise that another correction of 10% or more can be expected again in the months/years to come.

According to an article in Business Insider, the S&P 500 has seen corrections of 10% or more nearly every 1.5 years on average since 1957. The last meaningful correction was September-October 2014 when the S&P 500 was down 9.9% in less than a month, which is pretty darn close to the 1.5 year average. This most recent correction saw the S&P 500 decline12.5% in three months.

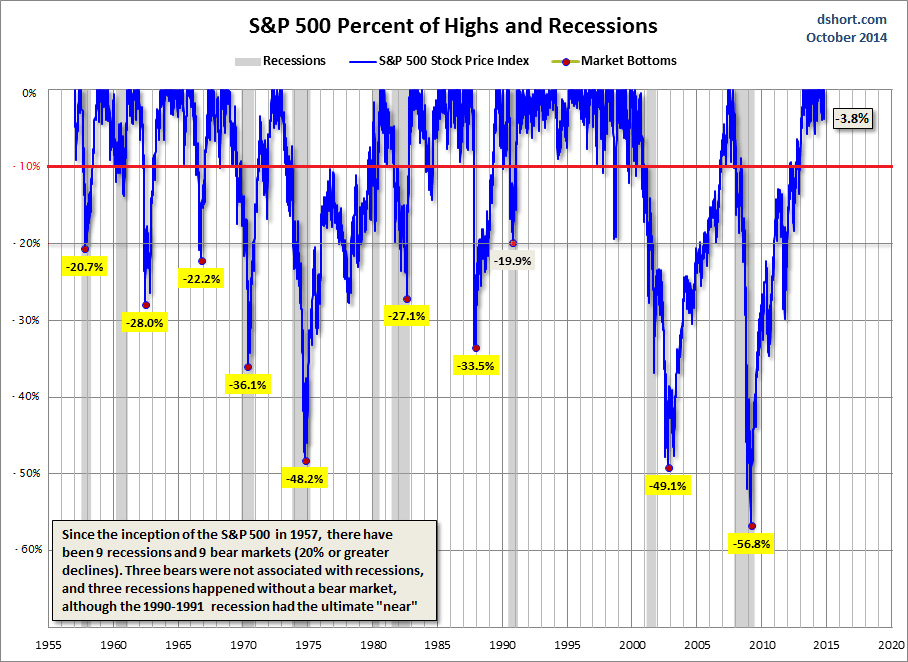

Is this latest correction a sign of trouble ahead? I would confidently say it is not. That is because, as mentioned before, market corrections are normal. Stock market corrections happen far more frequently than recessions do. And more often than we care to remember: the market has seen 10% plus declines 45 times since 1929! There have been 14 recessions during the same time period. Recessions are bad. Recessions are those events that cause prolonged and deep market corrections. Take a look at the chart below.

The areas marked by grey columns indicate periods of a US recession. The blue line chart indicates the performance of the S&P 500 as percentage declines from highs. As you can see, the S&P 500 has declined 10% or more from its highs several times before without collapsing.

Image source: financialsense.com

Virtually all severe market declines (20% or more) are associated with a recession. But the US economy is anything but in a recession. As next month, the US Federal Reserve is considering increasing interest rates for the first time in almost a decade. This is certainly a sign that the US economy is growing. The US economy will be churning forward for the years to come. There will come a time when the US enters a recession and the markets will take a major blow, but that time is not now.