Testimonials Home Page

Testimonials

“Justin has proven his worth by being more than an investment advisor. He tries to bring value to every interaction and is a name to watch in this industry going forward.” - Fabiana Lara, creator of The Next Big Rush

"Justin Hayek has been my investment advisor for over 7 years. I find his market knowledge invaluable. He has helped my portfolio grow, exceeding my expectations. I will continue to take advantage of his expertise and would highly recommend him to anyone looking for a fantastic advisor!" - Chase Shymkiw, Maple Ridge, BC

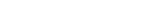

TFSA Contribution Limit Increased for 2023

Submitted by Justin Hayek on December 30th, 2022Starting January 1, 2023 you can contribute an additional $6,500 to your tax-free savings account (TFSA). This is an increase from last year's contribution limit of $6,000. This brings the lifetime total contribution limit to $88,000 - provided you were at least 18 years old in 2009.

With a TFSA, you have the ability to contribute up to the maximum allowable anytime during the calendar year. Any unused contribution room carries forward.

Contributions to your TFSA can be done in a couple different manners; in cash or in-kind. A contribution of cash is straight forward and typical of most contributions. We even have the ability to set up automatic monthly and bi-monthly TFSA contributions whereby funds are automatically withdrawn from your bank account and contributed to your TFSA here at PI Financial. A contribution in-kind refers to a contribution of a security to a TFSA. This can be a stock, bond, mutual funds, warrants, etc. So long as the security is registered account eligible, it can be contributed to your TFSA.

A couple of notes on contributions in-kind. A contribution in-kind may have tax implications however as CRA would deem this a disposition. That is, if the market value of the security is greater than the cost base, the contribution will trigger a capital gain. Conversely, contributing a security where the cost is greater than the market value (ie a loss), does not trigger a capital loss.

Benefits to Investing Through a TFSA

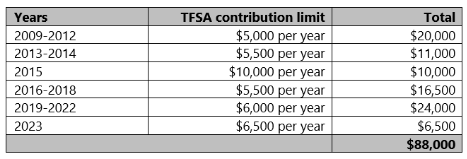

The benefit to investing in your TFSA is as the name implies - tax free gains. The monetary difference between a regular taxable account and a tax free account can be substantial. Take the below for example. A few assumptions: A resident of BC, in the top tax bracket, with an annual contribution of $6,000 at the start of each year, invested over 20 years earning a return of 10% per annum as interest income.

TFSA Growth vs Taxabale Account Growth

If you have not set up your tax free savings account or want to make a contribution to your existing TFSA contact Justin today (jhayek@pifinancialcorp.com or 604-718-7576).