Testimonials Home Page

Testimonials

“Justin has proven his worth by being more than an investment advisor. He tries to bring value to every interaction and is a name to watch in this industry going forward.” - Fabiana Lara, creator of The Next Big Rush

"Justin Hayek has been my investment advisor for over 7 years. I find his market knowledge invaluable. He has helped my portfolio grow, exceeding my expectations. I will continue to take advantage of his expertise and would highly recommend him to anyone looking for a fantastic advisor!" - Chase Shymkiw, Maple Ridge, BC

Tax Loss Selling Season: Get Ahead of the Herd

Submitted by Justin Hayek on September 27th, 2024Though we are just heading into October, tax loss selling season is about to kick off. Every year it appears as though this en masse selling starts sooner and sooner. Don’t be part of the herd of investors looking for a bid come this year’s deadline (December 30, 2024)…get ahead of them.

Here are 3 criteria to consider when determining if a security should be a candidate for tax loss selling;

Cash/balance sheet – Undercapitalized issuers in need of financing

If an issuer launches a financing before year end, they may be very well trying to raise capital at a time when investors are looking to crystallize capital losses. The likely outcome from this is greater selling pressure on the stock as investors look to crystallize losses are competing with those who are looking to sell a stock and use proceeds to reload into a financing. This creates a snowball effect by which selling brings on more selling. Depending on the issuer’s particulars (asset, management, project etc.) you may wish to become a buyer at this time as opposed to a seller.

Undercapitalized issuers will likely face more selling pressure than most this tax loss selling season.

Potential catalysts – Issuers with no catalysts or meaningful news flow in the short term

Junior mining issuers, and largely their share prices, are driven by liquidity and therefore by news flow. Declining volume due to lack of news flow almost always leads to a declining share price. This is something I have covered in a previous blog post here -

https://www.justinhayek.ca/blog/tsx-venture-exchange-ghost-town-trading-exploring-enigma-low-volume

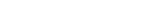

This is observable in the performance of the overall TSX Venture index. See below referenced chart. Blue bars represent $ volume transacted on the TSX Venture for the month. Red line represents the value of the TSX Venture index. Note the strong positive relationship between the two. You can apply this observation and the implication of liquidity or lack thereof to single securities.

Issuers with no catalysts or meaningful news flow in the short term will likely face more selling pressure this tax loss selling season.

Poor share price performance - Significant price declines year to date

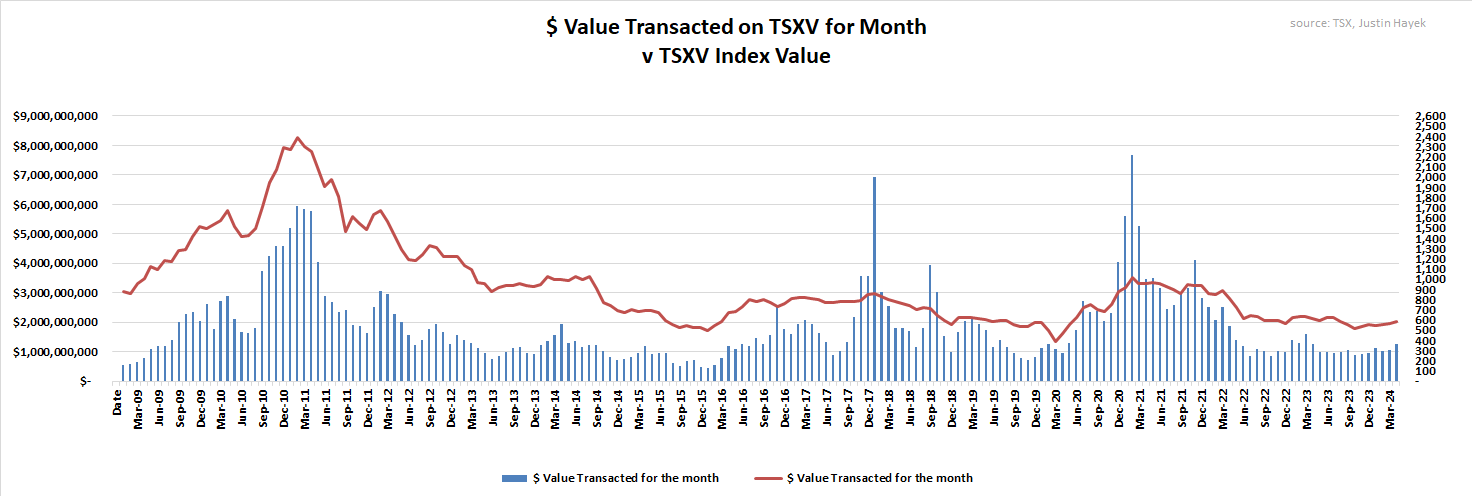

Looking at historical TSX Venture Index performance of Q1-Q3 vs Q4, there appears to be a positive relationship in that the two periods share same direction of performance. Going back to 2004, if the TSX-V Index’s Q1-Q3 performance is negative then 66% of the time Q4 performance is negative.

I believe this positive correlation can be applied to single securities as well. Should this be the case, expect those poorly performing stocks from Q1 through Q3 to face greater tax loss selling come Q4.

With the above in mind and in order to optimize after tax returns, the strategy than (barring material changes in the overall market) is to sell at least 30 days before the tax loss selling deadline (December 30, 2024) & re-buy those positions which are desirable and still of merit owning.

Please note however you must wait at least 30 calendar days before buying back the same security. Failure to do so will result in a superficial loss. If you have a superficial loss, you are unable to deduct it against your income.

Note the below however please consult your tax advisor/accountant for taxation advice specific to your situation;

Capital losses can be carried forward indefinitely

You can carry capital losses back up to 3 years

The above information pertaining to tax info only applies to Canadian equities and Canadian tax payers