Testimonials Home Page

Testimonials

“Justin has proven his worth by being more than an investment advisor. He tries to bring value to every interaction and is a name to watch in this industry going forward.” - Fabiana Lara, creator of The Next Big Rush

"Justin Hayek has been my investment advisor for over 7 years. I find his market knowledge invaluable. He has helped my portfolio grow, exceeding my expectations. I will continue to take advantage of his expertise and would highly recommend him to anyone looking for a fantastic advisor!" - Chase Shymkiw, Maple Ridge, BC

'Tis the Season: Tax Loss Selling Season

Submitted by Justin Hayek on October 9th, 2023We are heading into tax loss selling season. This year might be ugly considering poor sentiment not only towards the mining sector specifically, but overall market as well. A couple of reasons why you might want to consider crystallizing capital losses well before this year’s December 27th deadline (for Canadian equities).

Right now we are seeing a bifurcation of the markets – companies are either part of the haves or the have nots.

The Haves – Have a standout/viable project, have a management team that has executed and have $

The Have Nots – Do not have any of the above

Building on the observation expressed by Michael Gray of Agentis Capital during an interview with Kai Hoffmann (of Soar Financial). You can watch the interview by clicking here or thumbnail below.

In sum, there are too many juniors chasing too little capital. Which is set to become more of a problem for many issuers if they held off raising capital over the summer, hoping for a better market in the fall. We are going to see price pressure on these companies as they seek financing right now. Existing investors are not interested in allocating additional capital to the sector and new investors are not coming into the sector.

Low liquidity environment – This is something I’ve pointed out in a previous blog post (link to post here).

A pick up in tax loss selling will exacerbate the downward pressure on share price for most, resulting in outsized declines. You might want to be a buyer at that time rather than a seller.

This low liquidity environment also builds on the previous point of the haves vs have nots. In this environment where risk capital is scarce, new investors are not coming in and existing investors are not allocating additional capital to the sector. And so the question becomes, “where will the sector get its capital from?”.

Answer - existing investors but only if they can sell their position in the same or another issuer to ‘reload’ in the financing. This will likely lead to many issuers being forced to raise capital at more expensive terms (ie lower prices, and more generous warrant terms) which will lead other existing investors of an issuer to sell the stock down in order to possibly ‘reload’ into the deal. A vicious cycle.

Considering the above, the strategy than (barring material changes in the overall market and to prices of resources) is to sell at least 30, if not 60 or more days before the tax loss selling deadline (December 27th) & re-buy those positions which are desirable & merit to still own.

Criteria for names on the chopping block (to sell):

Undercapitalized – need financing now or within the next 3-4 months

Lack of potential catalysts – within the next 3-4 months

Significant price declines over the last 1-2 years. Not from peak but rather against volume weighted average price

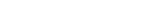

Looking at historical TSXV performance of Q1-Q3 vs Q4 performance there appears to be a positive relationship in that the two periods share same direction of performance. Going back to 2004, if Q1-Q3 performance is negative then 2/3 of the time TSXV Q4 performance is negative

A couple of notes regarding capital losses and taxation however please consult your tax advisor/accountant;

Capital losses can be carried forward indefinitely

You can carry capital losses back up to 3 years

The above information pertaining to tax info only applies to Canadian equities and Canadian tax payers

Though I would never recommend to make an investment/divestment solely for any tax benefits, taxation is an important part to an investor’s overall returns. Investing with the appropriate tax minimization strategy can help you generate better returns over the long term. The above described strategy is one such method.

If you wish to discuss how you might be able to use this strategy to your advantage please contact Justin today (jhayek@pifinancialcorp.com).